Family Office, Accountants, Lawyers

At Keshet, we strongly believe that getting to know the Donor-Advised Fund (DAF) model, along with all the related information that appears below, will help you when it comes time to advise your clients about their tax-deductible donations, as you together discuss the solution that will provide them the best tax benefits while enabling them to achieve their desired impact on society.

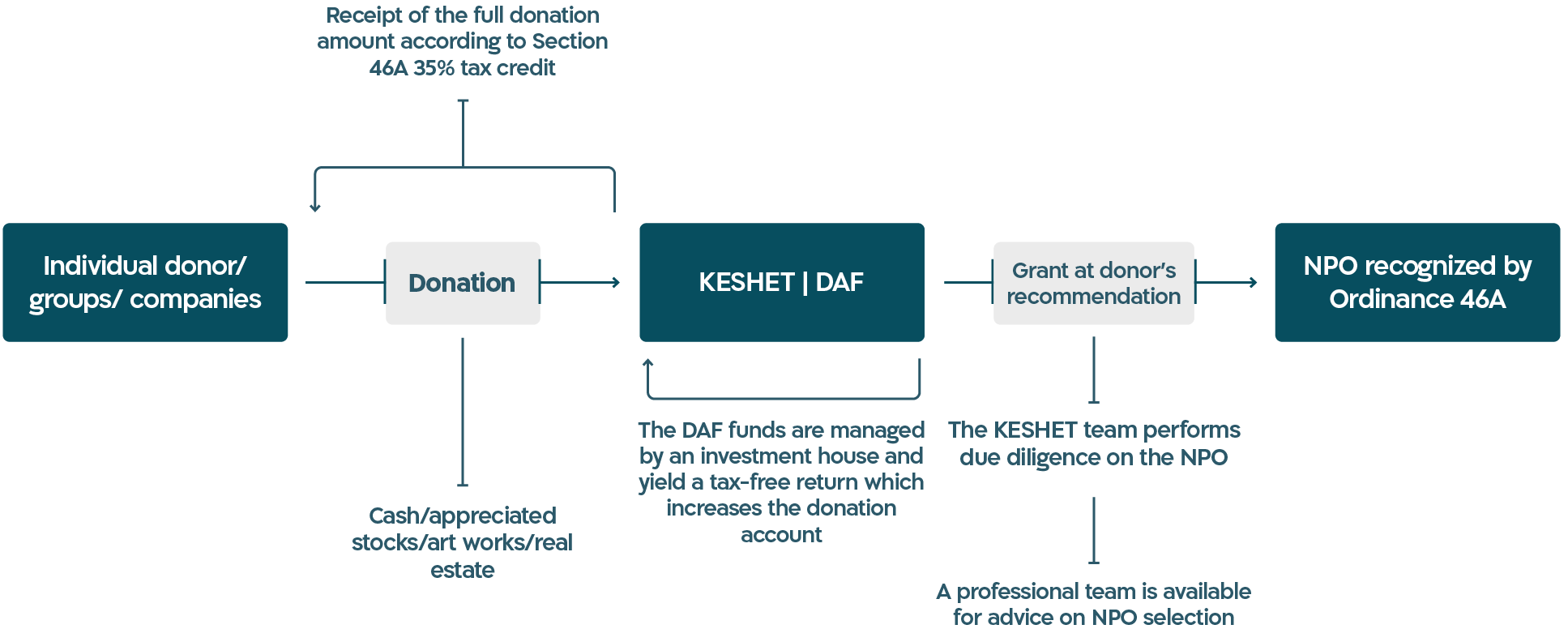

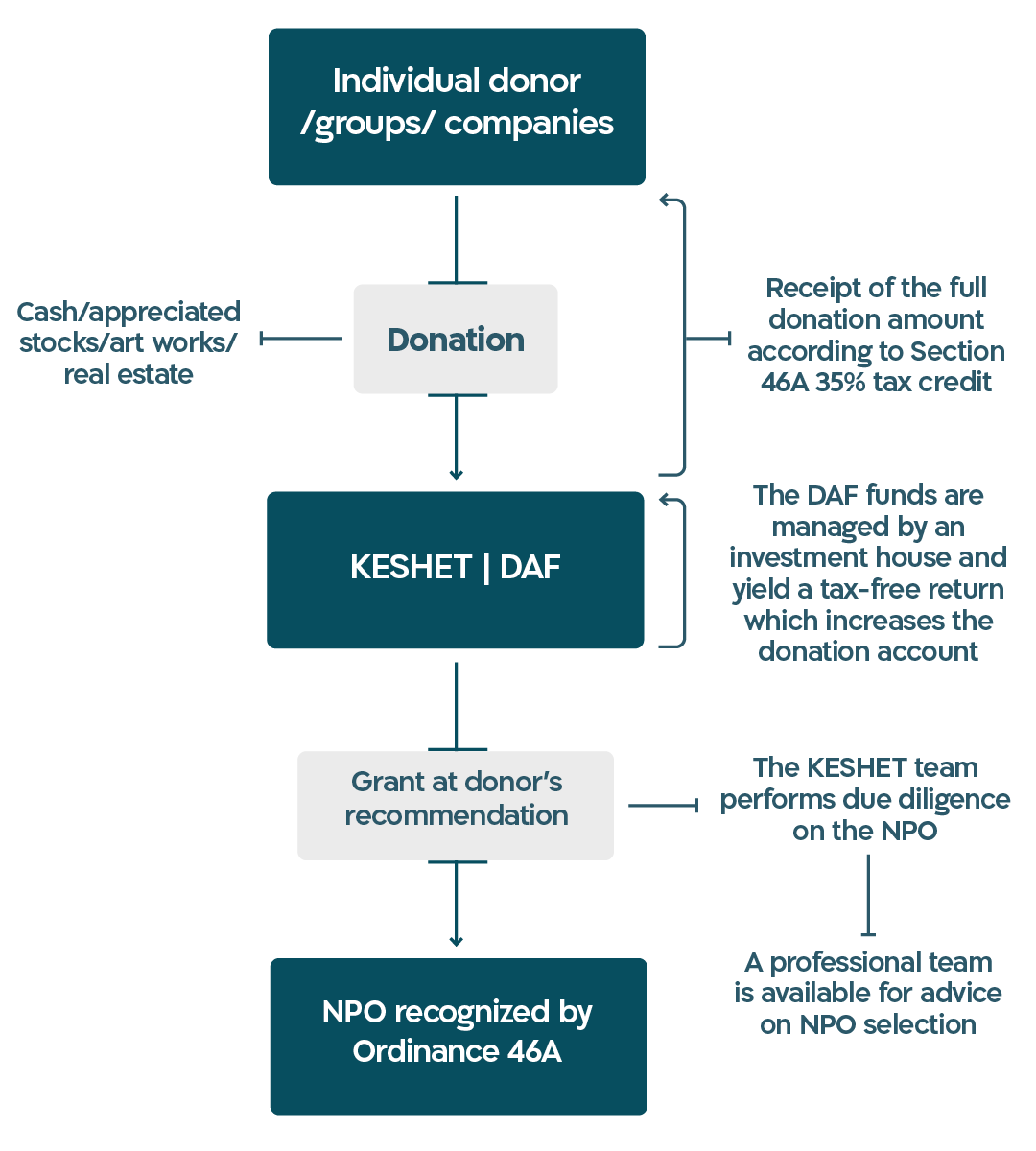

How does the financial model work?

The DAF model is an innovative financial tool for managing tax-deductible donations in accordance with the regulations set by the State of Israel. The model is active in the US, Canada, England, Australia and more.

Using the model, one can transfer a donation to Keshet and immediately receive a receipt for tax credit, as Keshet is a public benefit company with a permit under section 46 of the Israeli Tax Authority. Then, in the years to come, one can decide when and to which organizations, of those that have been thoroughly checked and approved by Keshet, one wishes to donate.

Keshet accepts a wide variety of assets as donations: Appreciated stocks, cash, real estate and even art objects.

Funds can be invested at an investment house, where they accumulate in value and earn tax-exempt dividends, enabling the donor later on to generate an even greater impact.

For additional information, contact us info@keshet-il.org

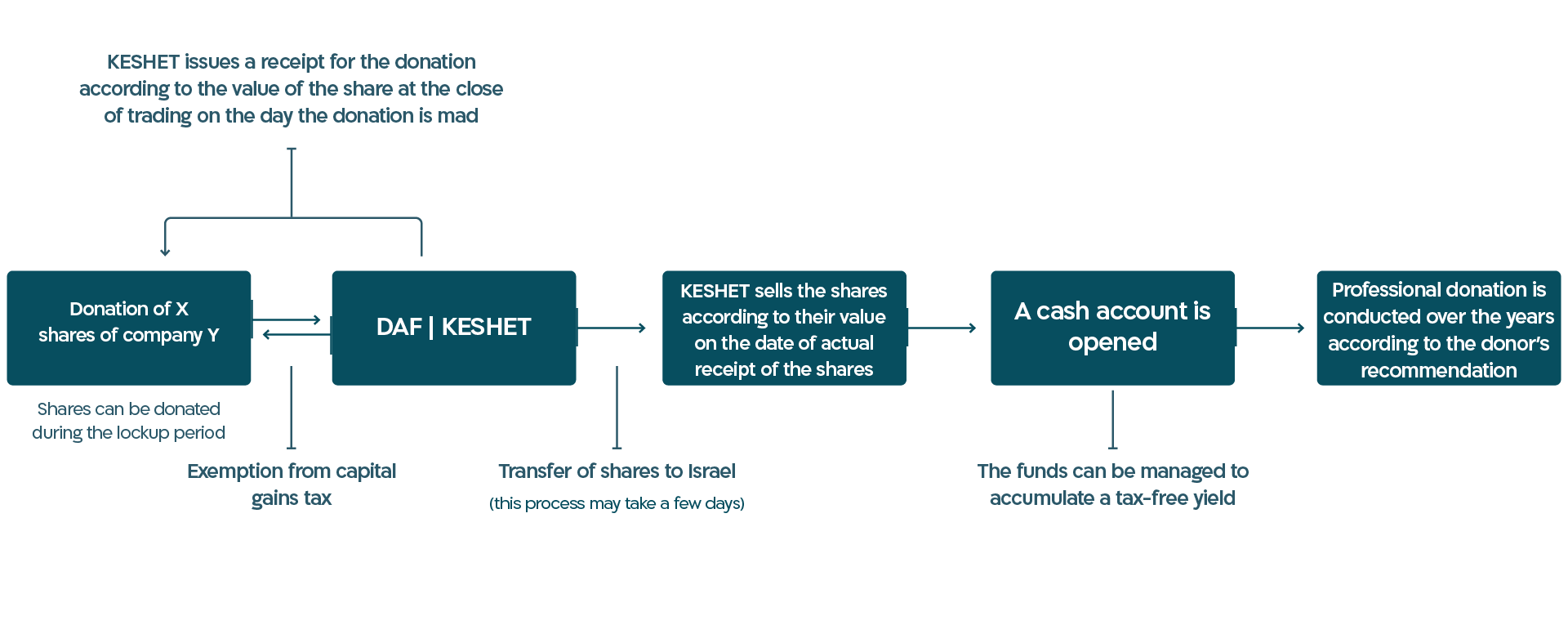

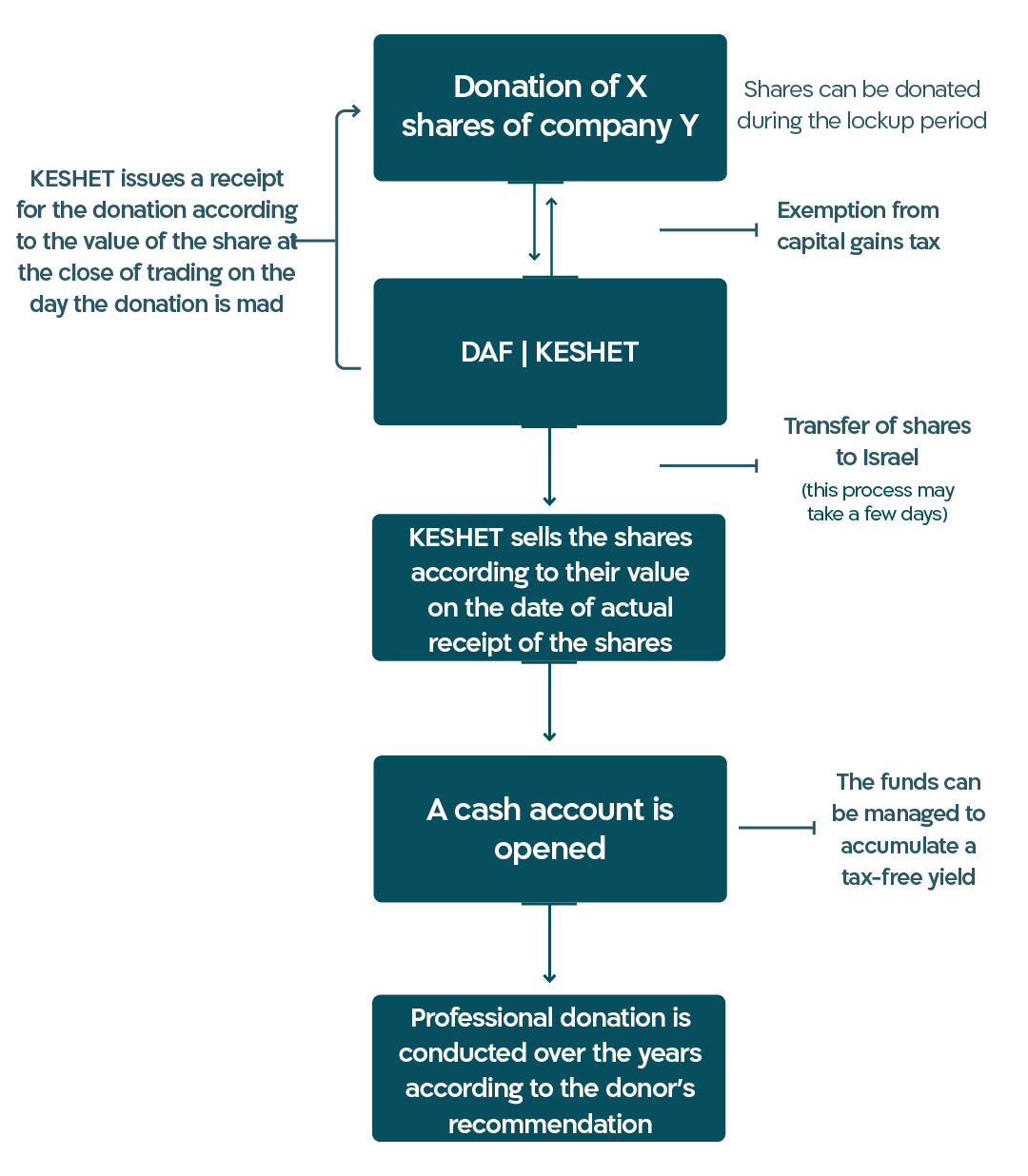

Donating Appreciated Stocks

Keshet receives a variety of assets for donation – including appreciated stocks, which are exempt from capital gains tax.

Upon transfer of their shares to Keshet, donors will receive a receipt for their donation under section 46. The value of the stocks will be determined upon the closing of the trading day.

The process of donating stocks takes several days.

*The information on this site should not be construed as tax or legal advice. Keshet recommends that donors consult with qualified tax advisors and lawyers who have expertise in the country from which the assets will be donated.

Advantages of the DAF model

*

Tax Benefit Optimization

A separation between the donation to Keshet and its transfer to an organization at a later date, while receiving the maximum tax credit.

*

Simplicity

Keshet’s platform provides information in a way that is easy to manage and to understand.

*

Trust

Keshet thoroughly vet and approve every organization according to Israeli regulations.

*

Continuity

The fund can be passed on to future generations, creating a family heritage of philanthropy.

*

Multiple Options to Donate Assets

Appreciated stocks, cash, real estate and even art objects.

*

Flexibility

It enables donors to contribute when they feel the timing is right.

*

Involvement

Donors can transfer the funds through Keshet and stay highly involved with the designated organization.